IRS Identity Verification PIN: Useful Tips

Effective management of your IRS Identity Verification PIN is not only recommended, it is essential to your financial security. The importance of this PIN in preventing fraudulent tax activity cannot be overstated.

This guide provides a series of practical tips on how to get IP PIN from IRS and manage and secure this number. It will also explore how the utility of the 7ID App can enhance the security of your PIN.

Table of contents

- IRS IP PIN Explained

- When and How to Use IRS PIN?

- How to Get Your IRS PIN?

- What to Do if You’ve Lost Your IRS PIN?

- How to Securely Store Your IRS PIN in the 7ID App: Guidelines

IRS IP PIN Explained

Simply put, the IRS IP PIN is a unique six-digit number that eligible taxpayers can use to add an extra layer of protection against tax fraud. Look at it as a special code that only you and the IRS (Internal Revenue Service) know. If someone tries to use your Social Security Number or Individual Taxpayer Identification Number to file a false tax return, this PIN will stop them.

Although originally intended for people who have already been victims of tax-related identity theft, anyone can apply for a PIN starting in 2021. The PIN is valid for one year, and you will receive a new one each year for your continued security. You can apply through the IRS website or simply call to get an IRS PIN.

When and How to Use IRS PIN?

When you have received your IRS Protection PIN, a unique six-digit code, use it every time you do your taxes. If you're using tax software, it will ask for your IP PIN at some point. The PIN helps confirm to the IRS that it's you filing your return, not someone pretending to be you. If you have a tax professional helping you with your taxes, be sure to give them your IP PIN.

Remember to use your IP PIN not only for the current year's tax return but also when you file tax returns from previous years.

Remember, you get a new PIN each year, so you'll need to request a new one when it's time to file your taxes again.

How to Get Your IRS PIN?

Many wonder, “How can I get my IP PIN from the IRS online?” You can use the “Get an IP PIN” feature on the IRS website to obtain it. If the online method doesn't work, the IRS offers a dedicated phone line at 800-908-4490. You can call anytime, Monday through Friday, from 7 a.m. to 7 p.m., as per your local time zone, for specialized assistance. If you haven't yet received your IP PIN in the mail, you can retrieve it from here. If you choose to receive an IP PIN voluntarily, you don't have to file Form 14039, also known as the Identity Theft Affidavit, with the IRS.

The IRS strongly recommends using the online Get an IP PIN tool as your first step, as it's generally the fastest and easiest method.

Please remember that the IRS starts to mail IP pins early in the year, so you should be on the lookout for this critical piece of mail. If you're thinking, “When does the IRS mail IP pin?” the exact date can vary, but it is typically sent in January or early February.

What to Do if You’ve Lost Your IRS PIN?

Every tax season, many taxpayers find themselves scrambling with an IRS PIN request as they realize they've lost their PIN. If this happened to you, and you want to know how to find IRS PIN, follow these steps:

- The first step in solving this problem is the IRS pin retrieval process. To retrieve your IP PIN, use the “Get an IP PIN” tool on the IRS website.

- If step 1 doesn't work, contact the IRS by calling 800-908-4490. They offer specialized assistance with retrieval issues.

- If you are sure you are a victim of tax-related identity theft and can't find your IP PIN, contact the IRS immediately. Inform them of your situation and request a new IP PIN.

- Always keep your IP PIN in a safe place and never share it with anyone to avoid putting your tax information at risk.

- Finally, if you suspect your IP PIN has been misused or compromised, immediately contact the IRS to report it.

To add an extra layer of protection to your IRS IP PIN, consider using the 7ID IRS PIN Code Safekeeper App. This app helps you securely store and manage your PIN, reducing the risk of it being lost or compromised.

How to Securely Store Your IRS PIN in the 7ID App: Guidelines

The IP PIN is a secure tool available to protect your returns from identity theft, so it's a great way to protect yourself. So, here's how to store your IRS PIN using the 7ID App:

- Download the 7ID App to your device and select the “PINs and Codes” feature.

- Once set up, begin adding and organizing your codes within the app.

The 7ID App is specifically designed to securely store PINs, acting as a digital safe for all your important codes.

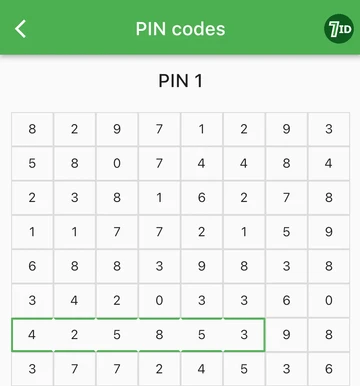

A unique feature is its Code-hiding and Memorizing Technology. When you enter your code, 7ID generates a mix of numbers that hides the original code. You then only need to remember the specific position of your code within this blend.

The app also allows Code Naming for better organization and increased security. With potentially multiple codes, giving each code a discrete name can help prevent unauthorized people from guessing the actual function of the stored codes when accessing the app.

7ID also prioritizes your privacy by ensuring only you can access the stored details. When you view your PIN, you'll see the random number mix, and only you know the correct location of your code. There's a “show code” function in case you forget the location of the code, but beware of prying eyes.

The 7ID app is available for Android or iOS.

Managing your IRS Identity Protection PIN should be seamless with the helpful tips provided. Remember, protecting this PIN is critical to your financial security. With tools like the 7ID IRS PIN Code Safekeeper App, the challenge of PIN management has been greatly simplified and made more robust.

Read more:

How To Create QR Code For Google Reviews: From Generating to Putting to Work

Read the article

Argentina DNI And Passport Photo App: Photos For Successful Application

Read the article